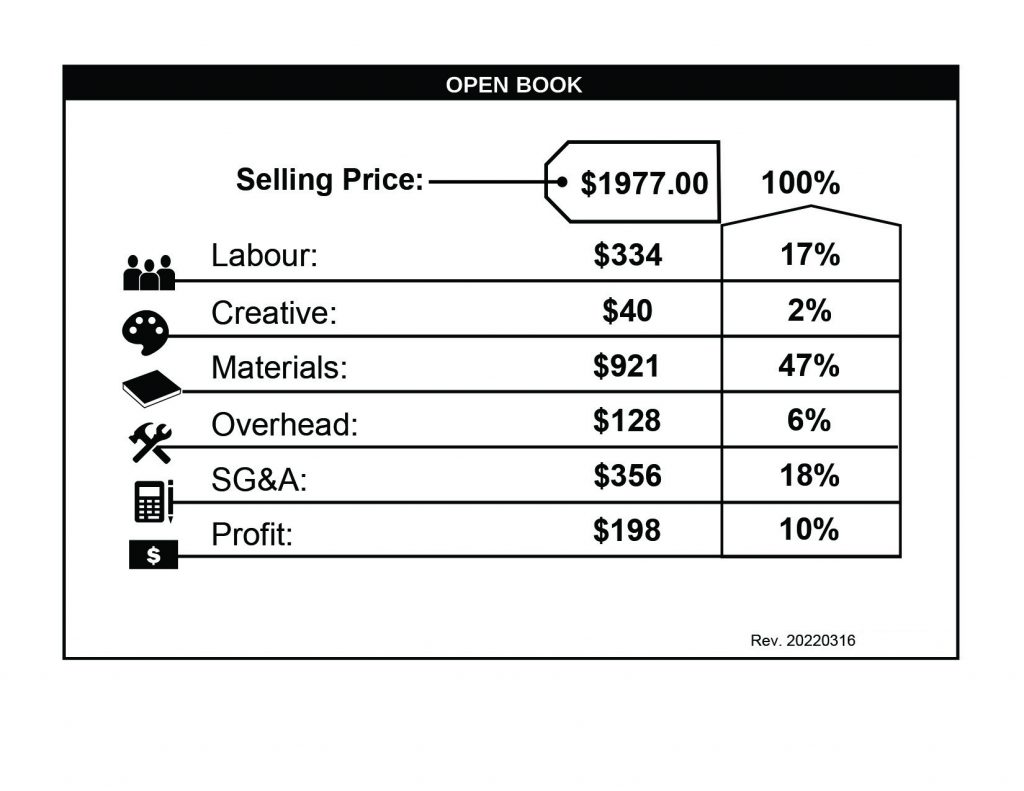

The OPEN BOOK is there to highlight that we are not making obscene profits on what we build, nor are we spending fortunes on marketing our brand. Together with the Impact Facts, it is also designed to emphasize that a big part of our spend is on our People. Finally, it also serves the purpose of highlighting the stark cost difference between sustainable production and modern “make it as cheap and consumable as possible”.

We have been through a few different versions, as you can see from some of the images on our site, but landed on one that follows closely a well established accounting hierarchy for manufacturers:

Labour

The formula to calculate the labour is as follow:

Labour = direct hours to produce x our labour Rate for the machine/work centre.

The rate is not the hourly pay, it includes ~ 20% extra to cover fringe benefits, which is very close to the real cost for our operations. The labour of components that are subcontracted is not included in this line, so the real labour value in the final goods is somewhat understated.

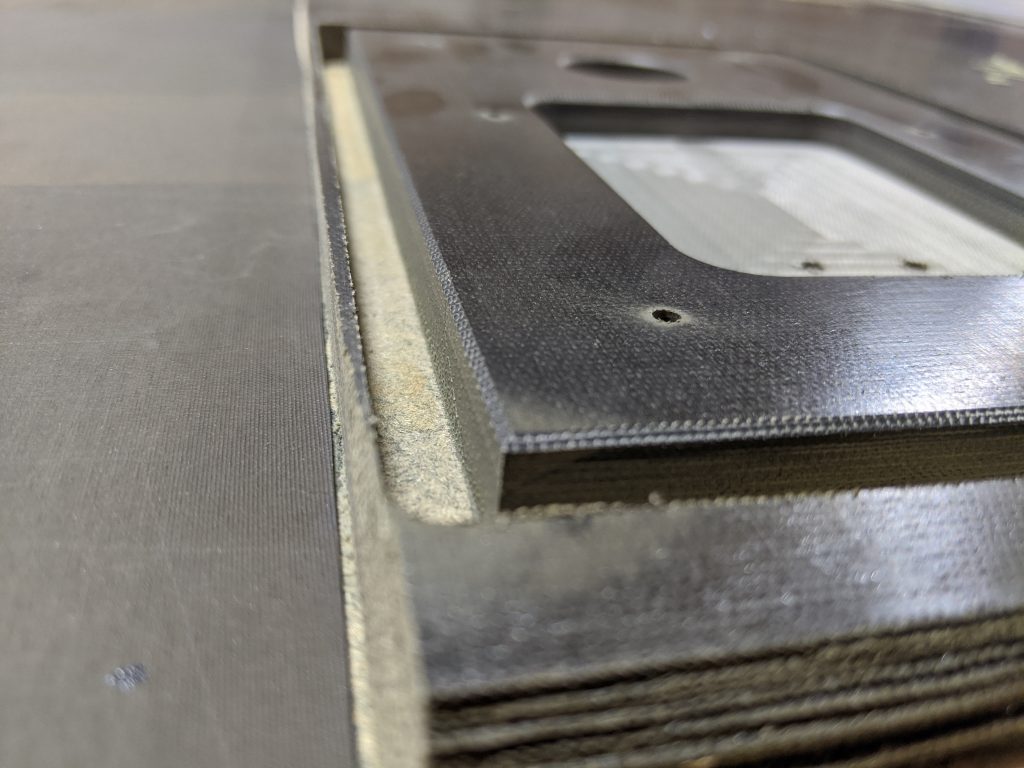

Material

This line is the direct landed cost of materials that go into the product. This includes the purchase price, inbound freight, duties, and if needed, exchange. It also includes subcontracted work. We use yield factors to cover for waste. When a material is re-directed from a waste stream of another process, we use the landed costs of that material.

Creative

This line is the amount paid to contributors not on our payroll such as Artists, Engineers and Designers. We try to contract with them on a commission-per-unit basis.

If we can’t, we take the fixed cost of the contribution and divide it across our estimated edition quantity.

Overhead

This line represents our factory expenses such as rent, electricity, and equipment costs. These amounts are very difficult to allocate into individual products because

1) We are in startup mode with no history nor sales budget and

2) we have synergies with our sister companies.

Currently we use a very old model that breaks it down into an hourly amount, so you will see it is always proportional to labour. The model takes 30% of all the costs and factors it into the different labour classifications while considering the square footage proportion occupied by those various departments.

In the future, as revenues and needs ramp up, we will adjust and recalculate according to forecast sales and more actual resource utilization.

SG&A

Selling, General, and Administrative expenses capture salaries and costs to sell, market and support back-end business operations such as IT, accounting and customer support. We currently have synergies with our sister company and so we are plugging this in at 18% of revenue, which is a fairly lean estimate for a manufacturing company.

Since there are so many moving parts to our model and we are just starting up, we will revise and date stamp the revisions as we go. The Open Book numbers are sourced directly from our ERP and we envision making available the underlying details if there is interest. Let us if you want them for any other of our products, and of course, please contact us if you have any thoughts, questions or comments or suggestions on our Open Book initiative! info@fabici.ca

Leave a Reply